If you’re wiring your trading stack to a bank or Prime of Prime (PoP) via FIX, success boils down to: clear commercial & technical scope, clean network and security, tight session/sequence discipline, precise mapping and risk controls, as well as robust monitoring and a tested failover plan. This playbook shows how to go live fast and stay live.

What FIX is? when to use it?

FIX (Financial Information eXchange) is a text‑based, low‑latency protocol widely used for order routing, execution, and market data. Connecting to a Liquidity Provider (LP) via FIX gives you:

- Direct, deterministic order flow (vs. REST/WS gateways)

- Rich execution states (partial fills, rejects, cancels)

- Mature risk and session primitives (heartbeats, resends)

Good fit: high‑frequency order flow, precise control, multi LP aggregation, exchange/ECN connectivity. Less ideal: one off, low touch flows better served by managed bridges.

Pre‑integration checklist (commercial + technical)

Before you touch a socket, align the following: Commercial / operational

- Trading scope: symbols, venues, session windows, supported order types (Market/Limit/Stop/Stop‑Limit/IOC/FOK/GTD/GTC).

- Economic terms: spreads/commissions, minimum ticket, rollover, swap rules, reject policy, COD (Cancel On Disconnect).

- SLA & contacts: NOC hours, escalation ladder, change window policy, weekend resets.

Technical

- FIX versions: Trade (usually FIX 4.2/4.4) vs Market Data sessions (often separate). Confirm data dictionaries.

- Environment plan: UAT vs PROD endpoints, static IPs for whitelisting, TCP ports, TLS/mTLS requirements, certificates.

- Message model: Execution Reports vs Drop Copy (ExecRpt/TradeCaptureReport), fills aggregation policy, multi account handling.

- Identifiers:

SenderCompID(49),TargetCompID(56),OnBehalfOfCompID(115)if routing, account tags (1/448/452/802 etc.). - Precision: price/size decimals, min tick, notional limits, symbol format (e.g.,

EUR/USDvsEURUSD).

Network & security hardening

- Transport: Prefer TLS 1.2+; if mTLS, exchange certs early; document renewal cadence.

- IP hygiene: Static egress IPs, strict LP ACLs both ways; avoid NAT churn.

- Clock sync: NTP (or PTP if co‑lo). Keep delta < 100 ms; FIX uses

SendingTime(52). - Throughput: Pre‑size bandwidth; set TCP buffers; enable

TCP_NODELAYfor latency‑sensitive legs. - Secrets: Store certs/credentials in a vault, not in repos. Rotate on staff changes.

Session & sequence discipline (the #1 go‑live blocker)

Core Admin MsgTypes: Logon(A), Logout(5), Heartbeat(0), TestRequest(1), ResendRequest(2), Reject(3), SequenceReset(4).

Golden rules

- Persist incoming/outgoing

MsgSeqNum(34)across restarts. Do not reset casually. - Answer TestRequest(1) with Heartbeat(0) echoing

TestReqID(112)within your heartbeat interval. - On gaps, send ResendRequest(2) with precise ranges; honor LP resends; fill missing messages.

- Prefer SequenceReset(4) GapFillFlag=Y for administrative gap‑fills (don’t alter state).

- Use

PossDupFlag(43)=YwithOrigSendingTime(122)on resends; de‑duplicate idempotently. - Align daily reset policy (some LPs reset at 00:00 UTC; others maintain running sequences).

Timeouts (typical)

HeartBtInt= 30s; consider 15s for HFT.- Disconnect if 2× missed heartbeats; backoff reconnect (e.g., 5s→10s→30s, max 60s).

Order flow you must get right

Primary messages

- NewOrderSingle (D)

- OrderCancelRequest (F)

- OrderCancelReplaceRequest (G)

- ExecutionReport (8) — your source of truth

- OrderCancelReject (9)

- OrderMassCancelRequest (q) / OrderMassCancelReport (r) (if supported)

Best practices

- Provide stable

ClOrdID(11)(unique per day); mirrors in replacements/cancels viaOrigClOrdID(41). - Treat

ExecType(150)+OrdStatus(39)as the canonical state machine; don’t infer from side effects. - Keep time‑in‑force consistent (

59): Day, IOC, FOK, GTC, GTD (ExpirationTime(126)). - Validate price bands, min/max qty, and notional checks before hitting the wire to reduce rejects.

- Respect LP‑specific tags (e.g.,

Account(1),ClientID(109),HandlInst(21),TradeLiquidityIndicator(9730)variants).

Market data without surprises

Messages: MarketDataRequest (V) → SnapshotFullRefresh (W) and/or IncrementalRefresh (X); rejections via (Y).

Tips

- Request only what you use (L1 vs L2 depth) to avoid throttling.

- Honor MDReqID(262) echo; track book integrity via

MDEntryID(278)/MDUpdateAction(279). - Recover after disconnect: resubscribe cleanly; don’t stitch stale books.

- Understand policies: RFS vs streaming, refresh rates, throttles, symbol filters, trade vs quote channels.

Risk, throttles, and kill‑switches

- Pre‑trade: price banding, fat‑finger checks, max order qty/notional, per‑symbol and per‑account limits.

- Rate limits: client‑side throttling (orders/sec, cancels/sec); exponential backoff on 2xx administrative rejects.

- COD: if supported, enable Cancel On Disconnect; otherwise build a mass cancel on reconnect playbook.

- Kill switch: operator triggered mass cancel + session logout with auditable reason.

Observability & compliance (build it in day one)

- Structured logging: persist raw FIX (redact PII if needed) + parsed events. Rotate daily with retention.

- Metrics: session up time, resend volume, round‑trip latency (client send→ExecRpt receive), reject rates by reason.

- Tracing: stamp a

ClOrdIDto trade lifecycle ID; expose in dashboards. - Clock compliance: keep audit trail in UTC; record

TransactTime(60)and gateway timestamps if provided. - Record‑keeping: match your regime (e.g., 5–7 years). Include drop‑copy feeds if used.

Failover & disaster recovery

- Primary/Secondary sessions to the same LP (or multi LP aggregation). Ensure independent

SenderCompID/stores. - Hot‑standby engines with shared persistent stores prevent seq regressions.

- Network HA: dual ISPs/cross connects; redundant firewalls; health checked VIPs.

- DR runbooks: simulate site failover quarterly; validate gap fill logic after flips.

Conformance & negative testing plan

Must‑pass cases

- Happy‑path market/limit order → partial fill → replace → cancel.

- Throttling: burst 50 orders; observe admin rejects and backoff.

- Sequence gap: force missing

34; assert clean resend. - Heartbeat/TestRequest handling during traffic spikes.

- Market data resubscribe after mid‑fill disconnect.

- COD: drop link mid‑book → orders canceled (or your mass‑cancel executes).

Document each with input, expected ExecRpt(s), and final state.

Common integration gotchas (and quick fixes)

- Infinite resend loops: Your store rewound or LP reset unexpectedly → stop, reconcile highest known

34, apply gap fill, then reconnect. - Daylight Savings surprises: Set Use UTC everywhere; do not bind sessions to local time.

- Symbol mismatches: Normalize instruments at a single boundary; reject unknowns early with actionable logs.

- Decimal/lot size drift: Store per‑symbol precision server‑side; validate before encode.

- Silent timeouts: Missed TestRequest handling ensure heartbeat worker is independent of order pipeline.

Sample QuickFIX/J configs (Trade & Market Data)

# quickfixj-core (FIX 4.4) — defaults

[default]

BeginString=FIX.4.4

ConnectionType=initiator

HeartBtInt=30

ReconnectInterval=5

FileStorePath=./store

FileLogPath=./log

UseDataDictionary=Y

DataDictionary=FIX44.xml

CheckLatency=Y

MaxLatency=120

ValidateFieldsOutOfOrder=N

ValidateUserDefinedFields=N

SocketUseSSL=Y

SSLProtocol=TLSv1.2

# mTLS (optional)

# SSLCertificate=client.p12

# SSLPassphrase=********

# --- TRADE session ---

[session]

# Trading days/hours in UTC

StartTime=00:00:00

EndTime=23:59:59

UseLocalTime=N

TimeZone=UTC

SenderCompID=YOUR_TRADER

TargetCompID=LP_TRADE

SocketConnectHost=lp.trade.endpoint

SocketConnectPort=9901

ResetOnLogon=N

ResetOnDisconnect=N

# Consider NonStopSession=Y for 24/5 venues

# --- MARKET DATA session ---

[session]

StartTime=00:00:00

EndTime=23:59:59

UseLocalTime=N

TimeZone=UTC

SenderCompID=YOUR_MD

TargetCompID=LP_MD

SocketConnectHost=lp.md.endpoint

SocketConnectPort=9902

ResetOnLogon=N

ResetOnDisconnect=NTip: Keep separate stores per session; never share

SenderCompIDacross Trade/MD.

Minimal FIX tag cheat‑sheet

- Admin:

34MsgSeqNum,49/56Sender/Target,52SendingTime,112TestReqID,43/122PossDup/OrigSendingTime. - Orders:

11ClOrdID,41OrigClOrdID,55Symbol,54Side,38OrderQty,44Price,59TimeInForce,21HandlInst. - State:

150ExecType,39OrdStatus,17ExecID,37OrderID,32/31LastQty/LastPx,14CumQty,151LeavesQty. - MD:

262MDReqID,268NoMDEntries,269MDEntryType,278MDEntryID,279MDUpdateAction.

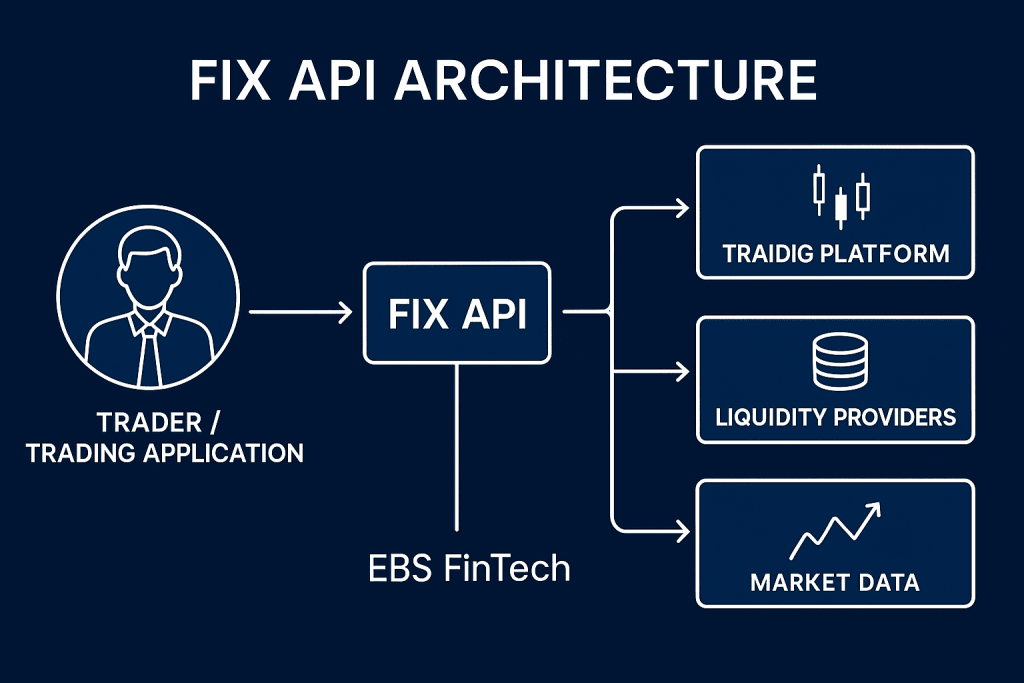

How EBS FinTech helps (fast, safe, production ready)

- Connectivity & Aggregation: Multi LP FIX onboarding, symbol normalization, smart‑routing.

- Bridging: MT4/MT5, cTrader, TradeView, xTrader connectors and risk‑books.

- Hosting: Low latency VPS/co‑lo, DDoS‑hardened edges, 24×5 NOC with SRE on call.

- Risk & Controls: Pre‑trade gates, throttles, COD/mass cancel playbooks, kill switches.

- Observability: Central FIX log lake, dashboards (latency, rejects, resend heatmaps), alerting.

- Conformance: LP test harnesses, negative testing, audit‑ready runbooks.

Get a 30‑minute technical review of your current FIX setup (gratis) and a prioritized punch list to de‑risk go‑live.

Contact: EBS FinTech · Brokerage Tech • Prop Trading • Crypto Infrastructure

[email protected] | ebsfintech.com