If you’re running a prop firm or challenge platform, you’re living in a high stakes balancing act. You need fast, frictionless onboarding to drive growth. But you also need to stop payment fraud, block sanctioned users, and keep your payment partners (PSPs, banks, crypto ramps) happy.

Let’s be honest: most compliance solutions are clunky. They treat every new user like a suspect, forcing them to jump through hoops just to buy a challenge. This kills your conversion rates.

The problem is treating Know Your Customer (KYC) and Anti Money Laundering (AML) as a legal checkbox.

This post is a practical guide on how to do exactly that, using smart, risk based controls powered by Sumsub, and how EBSWare Prop makes it a turnkey solution.

Why KYC/AML Is a Business Critical Issue for Prop Firms

Even if you’re not a traditional broker custodying client funds, you’re still at the intersection of payments, identity, and payouts. Your payment partners will hold you responsible for having a robust risk based program.

We see firms struggling with four key risks every day:

- Payment Fraud: Stolen credit cards used to buy challenges, leading directly to costly chargebacks.

- Multi Accounting: Users signing up for multiple accounts to game your evaluation rules or promotions.

- Sanctions Exposure: Accidentally onboarding users from sanctioned countries or on terror watchlists.

- Payout Abuse: Money mule rings using your firm to launder funds or synthetic identities to cash out.

Your goal is simple: maximize verified revenue, minimize manual review headaches, and keep your partners comfortable.

The 3 Critical Moments for KYC (Without Hurting Onboarding)

The secret to high conversion is progressive KYC. Don’t hit a new user with a passport scan just to see your platform. Instead, strategically place your controls at the moments that matter.

1. Onboarding (The “First Impression”)

At the initial signup, keep it light.

- Low Friction: Start with email + phone OTP.

- Invisible Screening: In the background, run a check on their IP address (is it a VPN? from a high risk country?) and a device fingerprint (has this device been used for fraud before?).

- Delay Full KYC: Don’t ask for ID documents yet! Save the full Sumsub ID verification + liveness check for later.

2. Payments & Payouts (The “Money” Moment)

This is where the rubber meets the road.

- At Challenge Purchase: Use standard payment checks like 3DS and AVS. You can trigger a “silent” Sumsub sanctions screen for users from higher risk regions or those using prepaid cards.

- Before the First Payout: This is the perfect time for full KYC. The user is motivated—they want their money. Now you trigger the full Sumsub ID + liveness flow. This is also where you run full sanction/PEP (Politically Exposed Person) screening.

- For Crypto Payouts: Use a KYT (Know Your Transaction) tool to screen the destination wallet. Block any wallets linked to sanctioned entities or high risk activities.

3. Runtime (The “Ongoing” Relationship)

Your job isn’t done after the first payout.

- Behavioral Monitoring: Watch for red flags like a user’s IP address “impossibly traveling” from one country to another in an hour, or multiple funded accounts logging in from the same device.

- Periodic Rescreening: Automatically rescreen your funded traders against sanctions and adverse media lists every month (or before each payout) to catch any changes.

How Sumsub Makes This Easy for Prop Platforms

We like Sumsub for prop firms because it bundles everything you need into one API driven platform: ID verification, liveness/selfie checks, sanctions/PEP screening, and fraud signals.

The integration pattern is straightforward:

- Trigger Verification: When a user hits a high risk flag or requests their first payout, your system tells Sumsub to create an applicant.

- User Completes Flow: The user completes the ID and selfie scan in Sumsub’s simple web or mobile SDK.

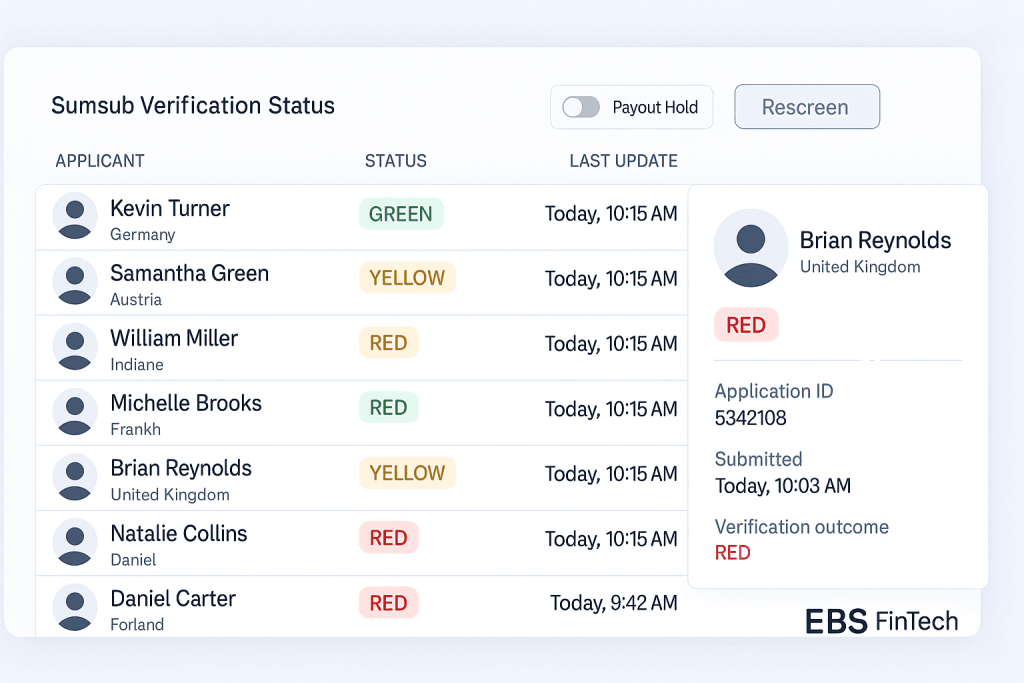

- Get the Decision: Sumsub reviews the data (often instantly) and sends your backend a simple webhook notification: GREEN, YELLOW, or RED.

- Automate the Outcome:

- GREEN: Automatically approve the user and unlock payouts.

- YELLOW: (e.g., a “fuzzy” match on a watchlist) Route to your operations team for a quick manual review.

- RED: (e.g., fake ID, sanctions hit) Automatically decline.

This GREEN/YELLOW/RED model lets you automate 95%+ of your decisions, freeing your team to handle true exceptions.

Building a Smart, Risk Based Program That Works

Don’t treat all users the same. Segment them into risk tiers and apply different rules.

- Low Risk: User from a Tier1 country (e.g., UK, Germany), clean IP, standard credit card.

- Action: No KYC at purchase. Full Sumsub KYC on first payout.

- Medium Risk: User from a higher risk jurisdiction, using a prepaid card.

- Action: Trigger full Sumsub KYC at purchase before their card is charged.

- High Risk: User on a VPN, IP mismatched with card country, or has a prior fraud signal.

- Action: Block the purchase or escalate to enhanced due diligence (manual review).

Key KPIs to Track Weekly:

To know if your program is working, you must track your metrics.

- Auto pass rate: (Target: as high as possible)

- Median verification time: (Target: < 90 seconds)

- Manual review rate: (Target: < 10%)

- Chargeback rate: (Target: < 0.5%)

The Turnkey Solution: EBSWare Prop + Sumsub

You could build all of this yourself. It would take a team of engineers, a compliance expert, and months of product development to wire up Sumsub, your payment processor, your KYT provider, and your backoffice tools.

Or, you can use EBSWare Prop.

Our white label platform is designed for this. We’ve built the “Identity & Risk Orchestrator” that connects all these pieces out of the box.

- Prewired to Sumsub: We handle the integration, webhooks, and decision rule logic.

- Unified Ops Console: Your team gets a single view of a user’s KYC status, payment risk, and payout screening. No more toggling between 5 different dashboards.

- Payments & Payouts Hub: We manage the 3DS routing, KYB for company payouts, and crypto KYT checks.

With EBSWare Prop, you can launch your firm with a bank grade compliance program in days, not months.

You don’t have to sacrifice conversion for compliance. By embedding smart, automated controls at the right moments, you can build a platform that traders love and partners trust.

Ready to launch your prop firm with a compliance first strategy? Contact EBS FinTech today to get a demo of the EBSWare Prop platform.

(Disclaimer: This is our practical guidance from the field, not legal advice. Always align with your legal counsel on your specific regulatory obligations.)