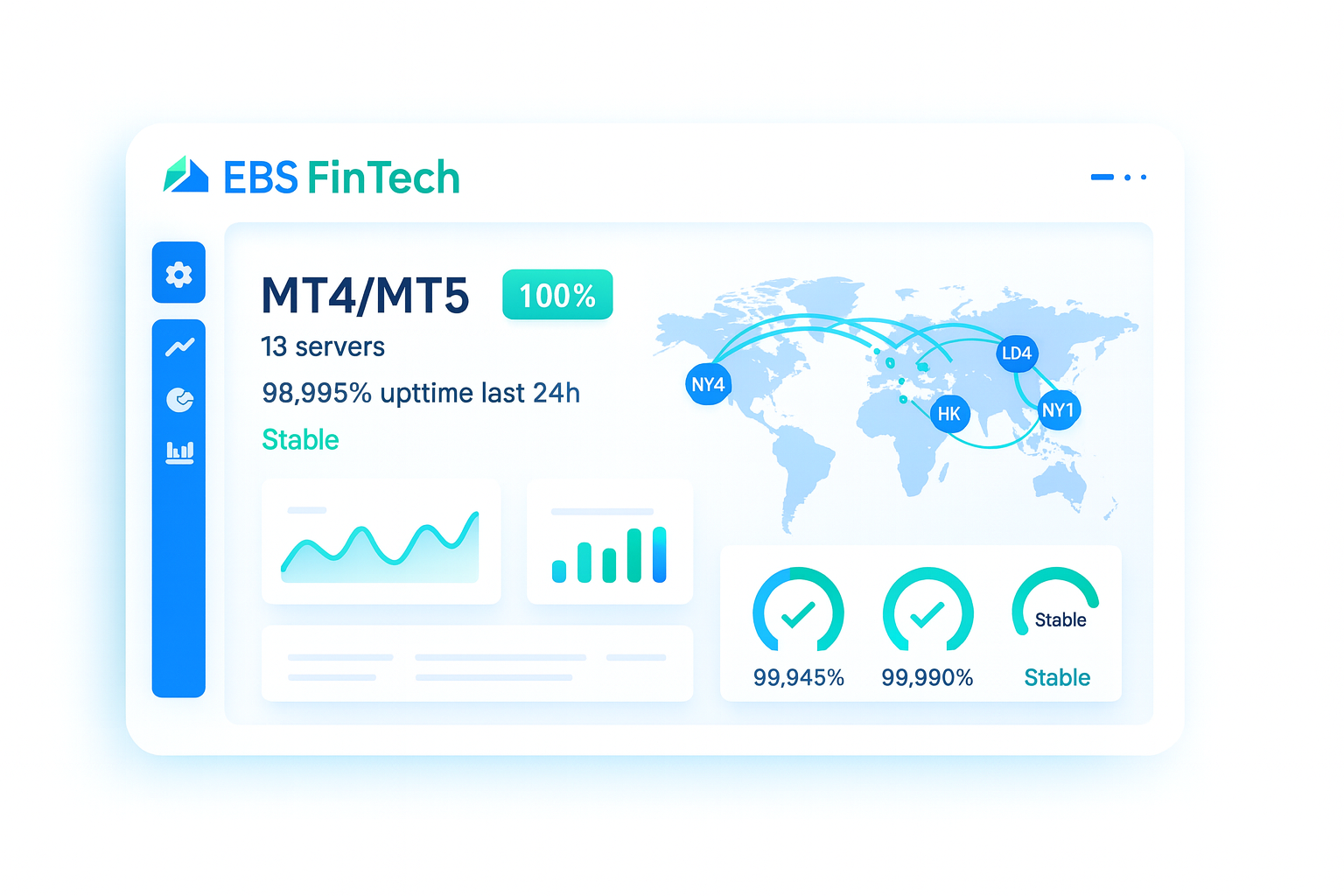

Low‑Latency MT4/MT5 Technical Hosting & 24/7 Managed Operations

EBS FinTech delivers enterprise‑grade MetaTrader 4/5 hosting, day‑2‑day operations, and proactive monitoring. With 20+ years in e‑trading infrastructure and a proven track record operating 40+ brokers concurrently, we help you launch, scale, and run reliable brokerage stacks—securely and compliantly.

20+ yrs

Trading infrastructure experience

40+ brokers

Operated concurrently

24×7×365

NOC & on‑call engineering

Up to 99.99%

Uptime SLA (by plan)

What We Host & Manage

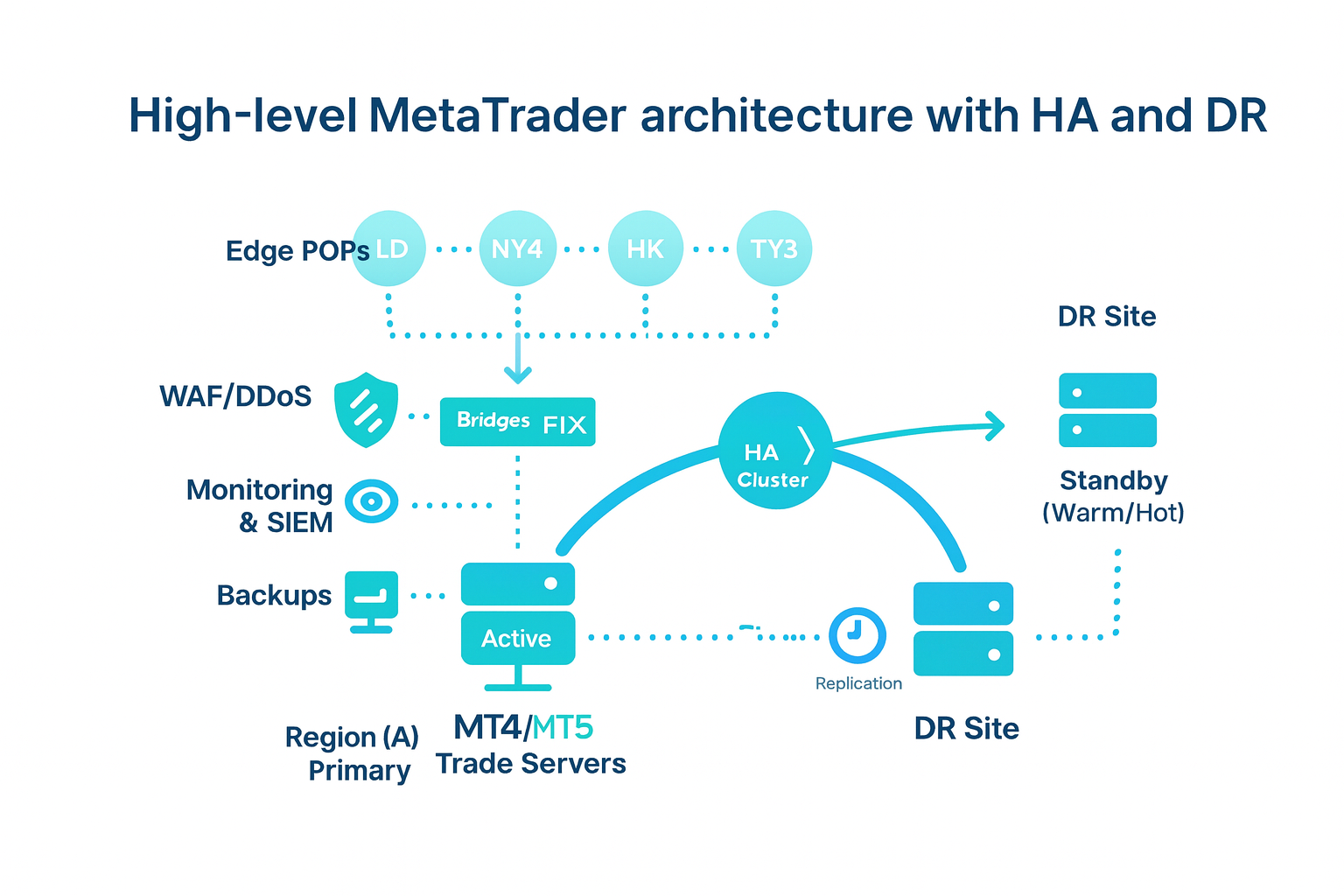

From greenfield deployments to complex multi‑region clusters, we architect, harden, and operate your MetaTrader stack end‑to‑end.

-

MT4/MT5 Servers — Main & backup trade servers, access servers, history servers, gateways.

-

Bridges & Liquidity — Integration with popular liquidity bridges (e.g., oneZero, PrimeXM, Centroid) and FIX hubs.

-

Plugins & Risk — Installation, versioning, and policy‑driven change control for dealer/risk plugins.

-

Security & DDoS — WAF, L3‑L7 DDoS mitigation, IP allowlists, MFA/SSO, OS hardening, key vaults.

-

Monitoring & SRE — Real‑time health checks, log retention, synthetic trades, SLA analytics, alert routing.

-

Backups & DR — Point‑in‑time recovery (PITR), encrypted snapshots, warm/hot standbys, DR playbooks.

Reference Architecture

A scalable, secure blueprint we tailor to your regulations, volumes, and liquidity stack.

Proven at Scale

Decades of uptime‑first engineering, with battle‑tested runbooks from 40+ live brokers under management.

Low‑Latency by Design

Global POPs (e.g., LD4/NY4/HK/TY3), tuned kernels, and network paths engineered for sub‑ms intra‑cluster hops.

Security‑First

Hardened OS images, zero‑trust access, secrets management, and policy‑driven change control with approvals.

Included in Managed Operations

- 24/7 NOC Proactive monitoring, alerting & incident response

- Patching Monthly OS & platform updates with rollback safety

- Capacity Elastic scaling, performance tuning & load tests

- Vendor mgmt Gateways, bridges & liquidity connectivity

- SLA Uptime targets up to 99.99% (by plan)

- Compliance Log retention, access reviews, audit trails

- DR drills Scheduled recovery tests & RTO/RPO reports

Optional Add‑Ons

- Advanced SIEM Correlation rules & threat intel feeds

- Geo expansion Additional POPs & cross‑region replication

- Latency audits Tracing & route optimization

- HFT readiness Kernel bypass & NIC offload consulting

- SRE hours Custom automation, dashboards & runbooks

Plans & SLAs

Choose a plan that matches your volumes and risk posture. We size infrastructure based on symbols, sessions, tick throughput, and geography.

Launch

For new brokers / migrations

- Single region • HA trade servers

- Managed patches & backups

- Monitoring & on‑call

- SLA: up to 99.95%

Scale

For growing volumes & cross‑asset

- Multi‑AZ • Hot standby

- Advanced DDoS & WAF

- Bridge & FIX optimization

- SLA: up to 99.98%

Enterprise

For global coverage & DR

- Multi‑region active/standby

- SIEM, SSO & policy controls

- DR drills & audit reporting

- SLA: up to 99.99%

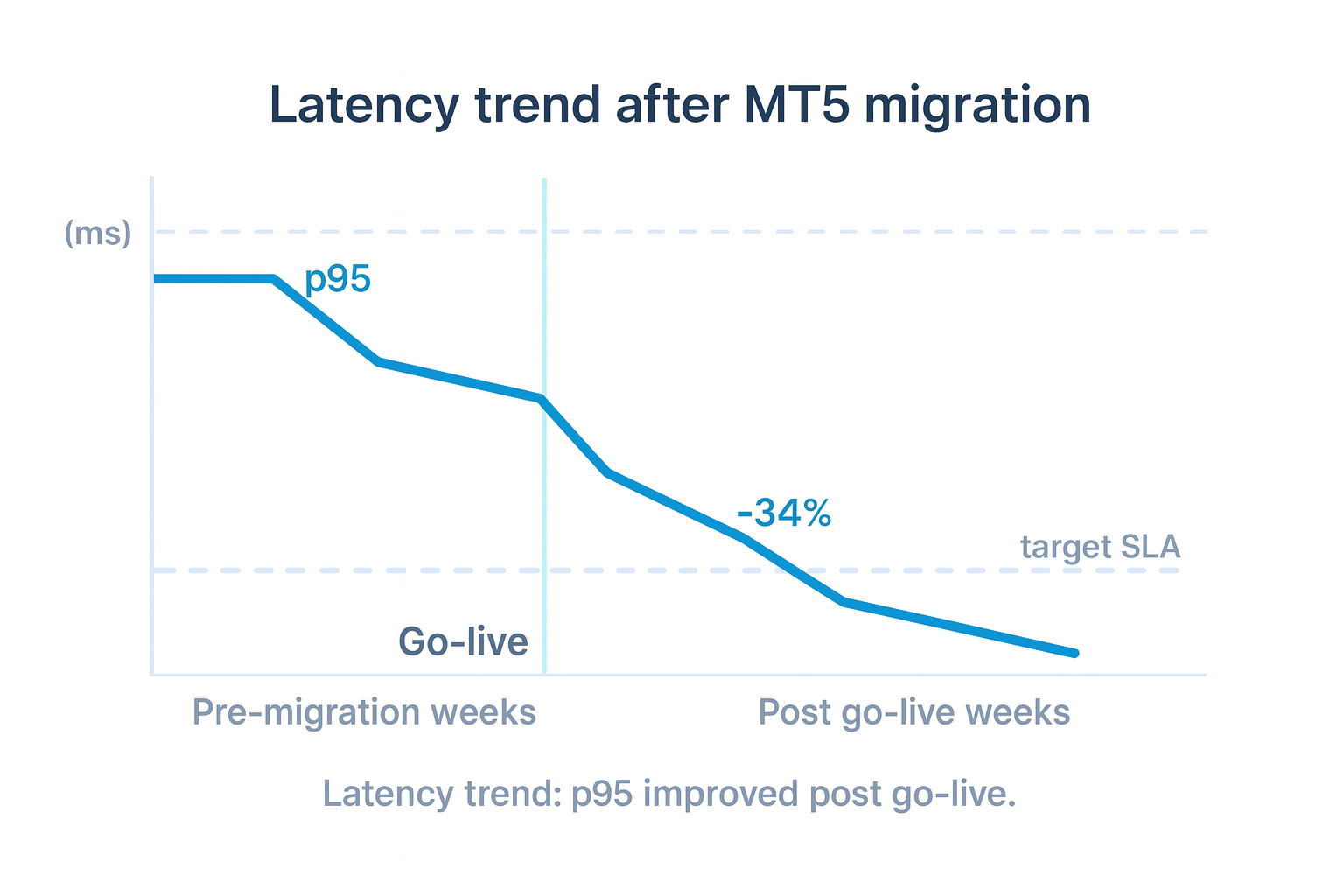

Proven in Production

Recent engagement: Multi‑AZ MT5 deployment for a cross‑asset broker, integrating PrimeXM and a custom risk plugin. Post‑migration results:

- ▼ 42% reduction in p95 order‑to‑fill latency

- ▲ 35% increase in throughput during peak sessions

- 0 critical incidents across first 90 days of go‑live

Implementation Process

Workloads, symbols, compliance, volumes, regions.

HA & DR topology, security policy, runbooks.

Harden, connect bridges, seed history, QA.

SRE monitoring, patches, capacity & SLA reports.

FAQ

Where are your hosting locations?

Can you work with our existing bridge/liquidity?

Do you provide brokerage or custody services?

What uptime can we expect?

Request a Technical Proposal

Tell us your expected symbols, sessions, target regions, and current monthly peak ticks. We’ll map an architecture with clear SLAs and monthly OPEX.

MetaTrader 4 and MetaTrader 5 are trademarks of MetaQuotes Ltd. EBS FinTech is an independent technology provider and is not affiliated with MetaQuotes.